When you’re close to age 65, you’ll start getting dozens of ads in the mail for “Medicare Advantage” plans from private commercial health care providers like HMOs. What do these plans offer and do they actually offer you an “advantage”?

Medicare Advantage Plans

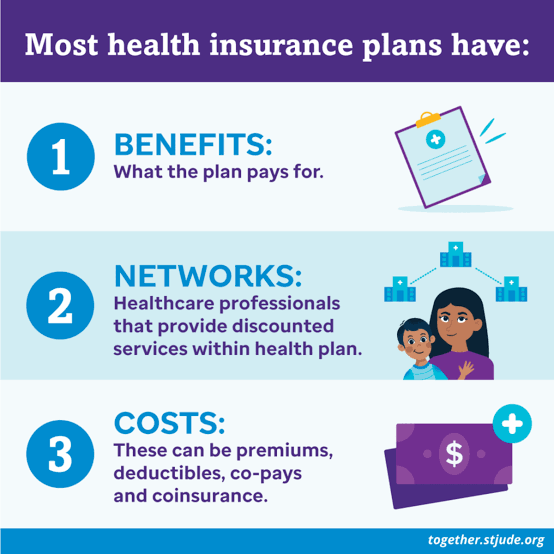

Medicare Advantage plans—sometimes referred to as “Medicare Part C”—are a type of health insurance offered by private companies that contract with the federal government’s Medicare program to provide all Medicare participants with the services and benefits of Part A hospital coverage and Part B coverage. external coverage/medical coverage) for ‘original Medicare’. In addition to all services that original Medicare covers, most Medicare plans include coverage for prescription drugs.

Medicare Advantage plans are typically offered by health maintenance organizations (HMOs), preferred provider organizations (PPOs), special fee-for-service plans, special needs plans and Medicare Medicare savings account plans.

In addition to all services covered by original Medicare, most Medicare Advantage services provide coverage for prescribed drugs.

On average, about 30% of all 55.5 million Medicare participants choose Medicare Advantage plans.

Advantages

On the plus side, Medicare Advantage plans offer participants simplicity, financial protection, and additional services.

- Comprehensive coverage: Most Medicare Advantage plans provide drug coverage at no additional cost, compared to traditional Medicare, under which participants must purchase a separate drug plan (Medicare Part D) for an additional premium of $10 to $100 per month.

- Out-of-pocket costs: The total costs of the covered service are covered for the services covered in Medicare Advantage plans — and once the annual cap is reached, the plan reimburses the full amount allowed for your medical services. Furthermore, by joining a Medicare Advantage plan, you can save money by dropping “Medigap” if you have it – an additional insurance plan that covers some costs such as co-pays or care outside the United States. Some Medicare Advantage plans also help students pay their monthly Medicare premium.

- Additional Benefits: Medicare Advantage plans usually offer benefits that traditional Medicare does not cover, such as dental, hearing, and vision care. Some plans even offer gym memberships.

Defects

Depending on the specific plan, Medicare Advantage plans can have some components that participants may not like.

- Limited Choice of Providers: People on a Medicare Advantage plan generally must choose their doctors and hospitals from a specific network of providers—and out-of-network services can be costly. However, studies have shown that information about provider networks can change frequently, making it difficult to know who is in the network. Many Medicare Advantage plan providers send updated lists of health care professionals and facilities included in their network. Although the Federal Centers for Medicare Services (CMS) now requires Medicare Advantage plans to notify participants whenever they significantly reduce the size of their provider network, the law allows plan providers themselves to define “significant.”

- Limited Flexibility: Medicare Advantage plans offer a 6-month period during which new participants can drop the plan and return to traditional Medicare. After the six-month period has elapsed, participants may return only once a year during the Medicare open enrollment period from October 15 to December 7.

- Additional Premium: Some Medicare Advantage plans require participants to pay a separate monthly premium in addition to the Medicare premium.

How do you decide

If you qualify for Medicare or already have conventional Medicare and the Medicare Advantage option, you should review the benefits and drawbacks of Conventional Medicare and the various Medicare Advantage plans that are available to you.

There are many Medicare Advantage plans available in your area, and each has slightly different costs, benefits, and quality. Most Medicare plan providers have websites with complete information and a contact phone number. Many of them even allow you to register online.

To find Medicare Advantage plans available in your area, you can use the online Medicare Plan Finder.

Medicare also offers other resources to help you make decisions, such as the CMS Medicare & You notebook, as well as a list of state health insurance advisors you can contact to learn more. You can also call Medicare directly at 1-800-MEDICARE (1-800-633-4227).

If you decide to enroll in a Medicare Advantage plan:

- Visit the plan’s website to see if you can register online; or

- Fill out the plan’s paper registration form. Contact the plan to obtain the enrollment form, fill it out, and return it to the plan. All plans must offer this option.

When you join a Medicare Advantage plan, you will have to give your Medicare number and the date of Part A and/or Part B coverage. This information is on your Medicare card. If you lose your Medicare card, you can request a replacement .

Beware of identity theft

Remember that your Medicare number contains your Social Security number, which makes it a rich prize for identity thieves. So, don’t give it or any other personal information to callers of Medical Plans.

Unless you specifically request to be contacted by phone, Medicare Advantage is not allowed to call you. Medicare Advantage plans should never ask for your financial information, including credit card or bank account numbers, over the phone.

If a Medicare Advantage plan calls you without your permission or arrives at your home without being invited, call 1-800-MEDICARE (1-800-633-4227) to report the plan to CMS