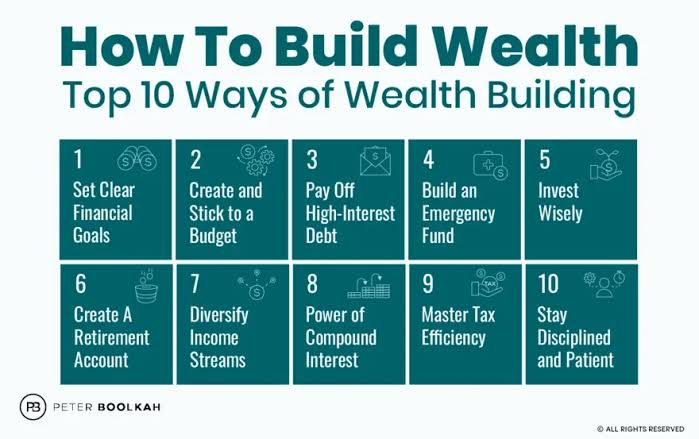

In today’s economy, building wealth isn’t just about saving money—it’s about making smart financial moves. Whether you’re in your 20s or approaching retirement, there are powerful strategies you can start using now to grow your wealth steadily and secure your future.

1. Refinance Your Mortgage to Lower Interest Rates

With interest rates fluctuating, 2025 is a great time to explore mortgage refinancing options. A lower rate can save you tens of thousands over the life of your loan.

Use online mortgage refinance calculators to see your savings.

Best for homeowners with good credit and equity.

Get the Right Life Insurance Policy

If you have dependents, investing in life insurance is essential—not just for protection but for potential tax-free wealth transfer.

Consider term life insurance if you’re under 50.

Look into whole life insurance with cash value for long-term planning.

Invest in Index Funds & ETFs

Passive investing through index funds offers high returns with minimal risk. Experts recommend starting with:

S&P 500 ETFs

Dividend-paying ETFs

Robo-advisors for beginners

Start an Online Side Hustle

In 2025, starting a passive income stream online has never been easier. Options include:

Affiliate marketing (Amazon, financial products)

Creating and selling digital products

Blogging in high CPC niches

Open a Health Savings Account (HSA)

An HSA allows you to save pre-tax dollars for medical expenses—and even invest the balance for growth.

Triple tax advantage: tax-free contributions, growth, and withdrawals

Only available with high-deductible health plans (HDHPs)

Final Thoughts

The key to wealth building in 2025 is to combine smart financial tools with consistent action. From refinancing your mortgage to investing in index funds and life insurance, every step you take builds a more secure future.