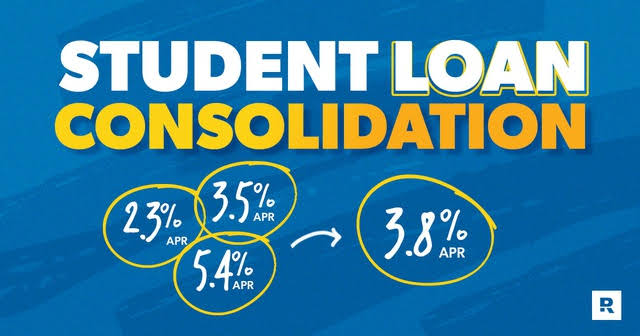

Struggling to manage multiple student loans? Learn how to consolidate student loans easily, lower your monthly payments, and take control of your financial future in 2025.

Student loans can feel overwhelming—especially when you’re juggling multiple payments, due dates, and interest rates. If you’re tired of tracking different lenders or want to simplify your repayment strategy, student loan consolidation could be a smart move.

In this guide, we’ll walk you through everything you need to know about how to consolidate student loans in 2025, from the basics to the step-by-step process, pros and cons, and common pitfalls to avoid.

What Is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple federal student loans into a single new loan, typically through the U.S. Department of Education. This new loan has one monthly payment and one interest rate (the weighted average of the loans you’re consolidating, rounded up to the nearest one-eighth percent).

Note: Private loans cannot be consolidated through a federal Direct Consolidation Loan, but they can be refinanced through private lenders

Benefits of Consolidating Student Loans

Simplified Repayment

Managing one loan and one payment is far easier than juggling several.

Lower Monthly Payments

Consolidation can extend your repayment term up to 30 years, reducing monthly costs (though you may pay more in total interest

Access to Income-Driven Repayment Plans

If your original loans didn’t qualify, consolidation may open the door to income-driven options like PAYE or REPAYE.

Loan Forgiveness Eligibility

Some borrowers become eligible for Public Service Loan Forgiveness (PSLF) only after consolidating.

Switch from Variable to Fixed Interest Rates

If you had variable-rate loans, consolidation locks in a fixed rate for the life of the loan.

Types of Student Loans That Can Be Consolidated

You can consolidate most federal student loans, including:

Direct Subsidized and Unsubsidized Loans

FFEL (Federal Family Education Loans)

Perkins Loans

PLUS Loans (Parent and Graduate)

Stafford Loans

Private student loans cannot be consolidated through the federal program, but they can be refinanced (more on that later).

How to Consolidate Your Student Loans – Step-by-Step

Step 1: Gather Your Loan Information

Use your Federal Student Aid account (studentaid.gov) to review your existing loans.

How to Consolidate Your Student Loans – Step-by-Step

Step 1: Gather Your Loan Information

Use your Federal Student Aid account (studentaid.gov) to review your existing loans.

Step 2: Check Eligibility

Only loans in repayment or grace period are eligible. If you’re in default, you must rehabilitate or agree to repay under an income-driven plan.

Step 3: Apply Online

Go to studentaid.gov/loan-consolidation. The application takes about 30 minutes.

Step 4: Choose a Repayment Plan

Options include:

Standard

Graduated

Extended

Income-Driven Repayment Plans (IDR)

Step 5: Continue Paying Existing Loans

Until your consolidation is complete (it takes 30–60 days), keep paying your current loans.

Pros and Cons of Consolidation

Pros Cons

One monthly payment Interest may increase over time

Lower monthly payments Can’t undo once completed

Access to forgiveness plans Loses progress toward forgiveness on original loans

Switch to fixed rate Extended repayment = more interest

Alternatives to Student Loan Consolidation

Refinancing with a Private Lender

If you have strong credit or a co-signer, refinancing may get you a lower interest rate. But you’ll lose federal protections like IDR and PSLF.

Income-Driven Repayment (IDR) Without Consolidation

Some federal loans are already eligible for IDR plans—check before consolidating.

Making Extra Payments

If your goal is to pay off debt faster, focus on the highest-interest loan first.

Common Mistakes to Avoid

Consolidating Before Graduation

You can’t consolidate while still in school full-time.

Ignoring Forgiveness Progress

Consolidating can reset forgiveness progress for PSLF or IDR forgiveness.

Assuming It Lowers Your Interest Rate

It won’t—it gives a weighted average, not a discount.

Consolidating Private Loans through Federal Program

Not possible—refinancing is the only option for private loans

Frequently Asked Questions

Q: Does student loan consolidation hurt your credit?

A: No. It doesn’t require a credit check and won’t negatively impact your credit score.

Q: Can I consolidate more than once?

A: Yes, but only if you have at least one new eligible loan to include.

Q: Is there a fee to consolidate?

A: Federal consolidation is free. Beware of third-party companies charging for this service.

Final Thoughts

If you’re a student managing multiple federal loans, learning how to consolidate student loans can be a game-changer. It simplifies your finances, gives you access to more repayment options, and can even lower your monthly payment. Just make sure it fits your long-term strategy and doesn’t interfere with any forgiveness plans you’re working toward.

Ready to simplify your student loan debt? Head to studentaid.gov and explore your options—it’s easier than you think.